In the dynamic cargo industry, protecting goods during transit is crucial for business survival, preventing financial losses, regulatory fines, and reputational damage. Liability coverage is a key strategy, offering protection against accidents, damage, or loss of goods, ensuring peace of mind and operational continuity in an unpredictable market. When integrating new fleets, prioritizing comprehensive liability coverage—including risk assessment services and proactive safety measures—is vital for establishing performance records and fostering trust among clients. Innovative solutions like real-time tracking and enhanced security features further strengthen cargo protection.

In today’s globalized trade landscape, ensuring comprehensive cargo and freight protection is paramount. This article offers a detailed guide to navigating the intricate world of transport security, focusing on key solutions for businesses. We explore the critical importance of freight protection, delving into risks and challenges faced by carriers. Key areas covered include liability coverage for financial safeguard, specialized insurance for new fleets, and enhanced security measures beyond traditional insurance. Understanding these components is essential to mitigate risks and ensure safe cargo transit.

Understanding the Importance of Freight Protection: Risks and Challenges

In the dynamic landscape of cargo and freight, protecting your goods during transit is not just a best practice—it’s imperative. Understanding the risks and challenges inherent in the supply chain is crucial for businesses to make informed decisions about their freight protection strategies. Without adequate coverage, companies face significant liability should their cargo sustain damage or be lost during transportation. This becomes especially critical when introducing new fleets into operations, as these assets are often substantial investments that require robust safeguarding.

The complexities of freight protection extend beyond financial losses; they can also include regulatory fines and reputational damage. With global trade regulations becoming increasingly stringent, ensuring compliance throughout the shipping process is a complex task. Businesses must navigate a web of rules and standards to avoid penalties while prioritizing the safety and security of their goods. Effective liability coverage plays a pivotal role in mitigating these challenges, offering peace of mind and operational continuity in an unpredictable market.

Liability Coverage: Protecting Against Financial Exposure

Liability coverage is a crucial component in comprehensive solutions for cargo and freight protection, especially for businesses introducing new fleets into their operations. As fleet size grows, so does the potential financial exposure from accidents, damage, or loss of goods during transit. Liability insurance provides a safety net against these risks, shielding companies from significant monetary losses that could cripple their operations.

This type of coverage is designed to protect against claims made by third parties, such as injured individuals or damaged cargo owners. It ensures that your business remains financially stable even in the event of a lawsuit or unexpected incident. By including liability coverage in your freight protection plan, you gain peace of mind and safeguard your new fleet’s financial health.

Insuring New Fleets: Comprehensive Solutions for New Transport Assets

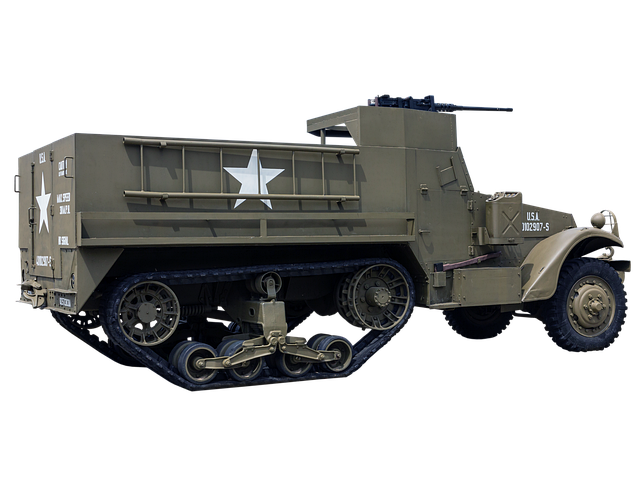

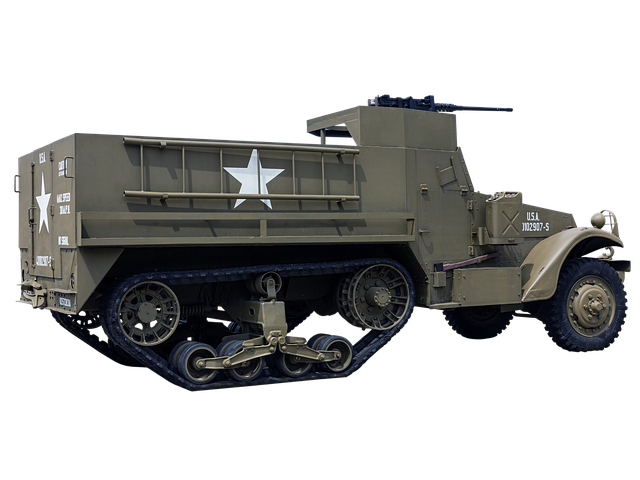

When introducing new fleets into your cargo and freight operations, ensuring comprehensive protection is paramount. Liability coverage for new fleets plays a pivotal role in safeguarding against potential risks and financial losses. This includes insuring against damage to the vehicles themselves, as well as liability arising from accidents or incidents during transit.

Comprehensive solutions should offer not just basic insurance but also include risk assessment services and proactive safety measures. By implementing these strategies, transport businesses can mitigate liabilities, enhance operational efficiency, and ensure the safe arrival of goods. Such proactive protection is especially crucial for new fleets, which require time to establish reliable performance and safety records.

Enhancing Security Measures: Beyond Insurance, Ensuring Safe Cargo Transit

In today’s digital era, enhancing security measures for cargo and freight protection goes beyond traditional insurance. While liability coverage is a crucial component, forward-thinking companies are investing in innovative solutions to ensure safe transit for their goods. This includes adopting new technologies and strategies that safeguard against potential risks, such as real-time tracking systems, advanced encryption for digital data, and enhanced security features within fleets.

New fleets, equipped with cutting-edge technology, play a pivotal role in this transformation. By integrating these modern solutions, companies can mitigate the risk of theft, damage, or loss during transit. This comprehensive approach to cargo protection not only provides peace of mind but also fosters trust among clients who rely on timely and secure delivery of their valuable shipments.

In conclusion, comprehensive solutions for cargo and freight protection are vital for mitigating risks and ensuring the safe transit of goods. By understanding the importance of freight protection, implementing robust liability coverage, and adopting enhanced security measures, businesses can safeguard their assets and operations. For those with new fleets, specific insurance solutions cater to the unique challenges of protecting valuable transport assets, offering a strong foundation for operational success and financial security.