Startups in high-risk sectors like trucking face challenges securing adequate insurance due to their unique, evolving environments. Comprehensive trucking insurance is crucial for mitigating risks, protecting financial assets, and ensuring uninterrupted operations. By understanding startup needs, developing tailored policies, comparing quotes from multiple insurers, conducting risk assessments, and leveraging technology, startups can balance cost and quality while securing vital protection against diverse sector-specific risks. Strategic risk management, demonstrated through case studies, enhances operational resilience without compromising quality or significantly increasing costs.

In the dynamic landscape of startups, balancing cost and quality in insurance policies is paramount. This article explores the unique challenges faced by young businesses, with a particular focus on the importance of comprehensive trucking insurance for those operating in logistics and transportation. We delve into strategies that bridge the gap between affordability and robust coverage, backed by real-world case studies demonstrating successful risk management. Understanding these nuances is key to ensuring startups thrive without compromising their financial health.

Understanding Startups' Unique Insurance Needs

Startups, by their very nature, operate in an environment filled with uncertainty and rapid growth. This presents unique challenges when it comes to insurance policies, especially in sectors like trucking, where comprehensive coverage is essential. Unlike established businesses, startups often have limited financial resources and a need for flexible, tailored insurance solutions that align with their specific risks.

Comprehensive trucking insurance, for instance, plays a critical role in protecting these new ventures from costly accidents, liabilities, and regulatory issues. It ensures that startups can continue operations without significant interruptions, providing peace of mind as they navigate the competitive landscape. Understanding these unique needs is the first step towards crafting insurance policies that offer both adequate coverage and affordable premiums, fostering a healthier environment for startup growth and success.

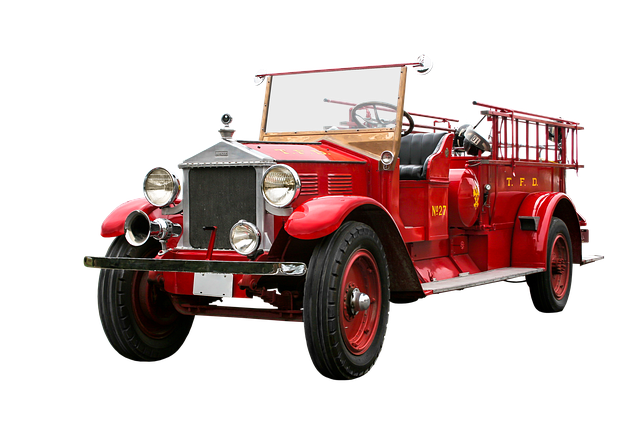

The Role of Comprehensive Trucking Insurance

For startups in the trucking industry, securing Comprehensive Trucking Insurance is not just a legal requirement but a strategic investment. This type of insurance goes beyond basic coverage to safeguard against a wide range of risks specific to the sector. From accidents and cargo damage to natural disasters and theft, comprehensive trucking insurance provides financial protection for both the business and its assets. By understanding their exposure, startup truckers can make informed decisions about risk management, ensuring they’re not left vulnerable to significant financial losses.

In a competitive market where quality service and reliable operations are paramount, comprehensive trucking insurance offers peace of mind. It allows startups to focus on growth and innovation without the constant worry of unexpected events derailing their progress. By choosing the right policy, these new businesses can balance their budgets while ensuring they’re adequately protected against potential catastrophic events, ultimately contributing to their long-term success in a dynamic industry.

Strategies to Balance Cost and Quality

To balance cost and quality in comprehensive trucking insurance for startups, it’s crucial to strike a sweet spot between robust coverage and affordable premiums. Startups often face financial constraints, making it imperative to secure adequate protection without overextending their budget. One effective strategy is to compare quotes from multiple insurers, allowing market competition to drive down rates. Additionally, evaluating risk levels through detailed assessments can help identify areas for improvement that reduce exposure, subsequently lowering insurance costs.

Customizing policies to align with the specific needs of a startup trucking operation is another vital step. Insurers offering flexible coverage options cater to unique scenarios, ensuring startups pay only for what they need. Furthermore, leveraging technology for risk management and fleet monitoring can prevent accidents and claims, ultimately leading to better rates. By adopting these strategies, startups can navigate the insurance landscape with confidence, securing comprehensive trucking insurance that both protects their assets and fits within financial constraints.

Case Studies: Successful Risk Management for Startups

Startups, by their very nature, operate on tight margins and must be strategic in managing risks to ensure long-term viability. Case studies highlight several successful approaches to risk management that have enabled young companies, particularly those in high-risk sectors like trucking, to secure comprehensive trucking insurance while maintaining a healthy financial profile.

One notable example involves a tech startup that, despite facing significant liability concerns due to its innovative but potentially hazardous product line, implemented robust safety protocols and employee training programs. This proactive approach not only improved their risk profile but also attracted investors who valued their commitment to responsible innovation. Similarly, a logistics startup focused on green transportation successfully negotiated with insurers by showcasing its commitment to environmental sustainability and offering data-driven proof of reduced claims and improved safety metrics. These real-world examples demonstrate that prioritizing risk management doesn’t have to compromise quality or increase costs disproportionately; instead, it can lead to more affordable comprehensive trucking insurance and enhanced operational resilience for startups.

Startups face a delicate balance when it comes to insurance, especially in ensuring they have adequate coverage without compromising their financial health. By understanding their unique needs, such as those outlined regarding comprehensive trucking insurance for businesses involving transportation, entrepreneurs can strategically navigate the market. Implementing cost-effective strategies and learning from successful case studies enables startups to secure quality insurance policies that protect their assets and enable sustainable growth. This approach is vital to navigating the challenges of early-stage operations while maintaining a robust risk management strategy.